Maximising Fuel Tax Rebates for Heavy Fleet: A Guide to Simplify and Save

- David

- February 10, 2025

- 06 Mins read

Maximising Fuel Tax Rebates for Heavy Trucks: A Guide to Simplify and Save

Fuel tax rebates can greatly reduce operating costs for businesses running heavy trucks and trailers, but many miss out on the full benefits due to the complexity of the claim process and the administrative workload involved. Thankfully, advanced solutions like Fuellox Fuel Management Systems simplify the process by automating fuel usage tracking and generating instant, accurate reports. In this guide, I’ll explain everything you need to know about fuel tax rebates and demonstrate how Fuellox can help heavy truck operators streamline their claims and maximise savings.

What Are Fuel Tax Rebates?

Fuel tax rebates, officially called fuel tax credits (FTC) in Australia, allow eligible businesses to claim back a portion of the fuel excise paid when purchasing fuel for business operations. The rebate amount varies depending on how the fuel is used, such as in heavy vehicles, equipment, or stationary machinery.

Eligibility for Fuel Tax Credits

To claim fuel tax credits, your business must meet specific criteria outlined by the Australian Government. The credits apply to businesses that use fuel for:

- Machinery, plant, and equipment.

- Heavy vehicles over 4.5 tonnes (primarily used on public roads).

- Off-road fuel use in industries like agriculture, construction, and mining.

For official guidance on eligibility, visit the .

Australian Government’s Fuel Tax Credit Eligibility pageCommon Challenges in Claiming Fuel Tax Rebates

Despite the benefits, many businesses struggle with:

- Complex Reporting Requirements: Tracking fuel usage and generating accurate reports can be time-consuming.

- Administrative Work: Manually collecting and organising fuel data often leads to errors or delays.

- Missed Opportunities: Without proper systems, businesses may overlook eligible claims.

How Fuellox Simplifies the Fuel Tax Rebate Process

In my experience working with businesses of all sizes, I’ve seen how systems like Fuellox Fuel Management Systems transform this cumbersome process. Here’s how:

1. Automated Data Collection

Fuellox captures real-time fuel data from your vehicles and equipment. Whether you run a fleet of delivery trucks or operate heavy machinery on a construction site, Fuellox tracks fuel consumption, eliminating the need for manual data entry.

2. Instant Report Generation

Generating reports for tax claims is often a headache. Fuellox provides instant, comprehensive fuel usage reports that meet the Australian Taxation Office (ATO) requirements. This ensures accuracy while saving hours of admin work.

3. Real-Time Monitoring

With Fuellox’s cloud-based platform, you can monitor fuel usage and trends in real-time. This not only simplifies tax claims but also helps identify inefficiencies, further reducing costs.

Read more about how Fuellox fuel management systems work.How does FUELLOX overcome these challenges?

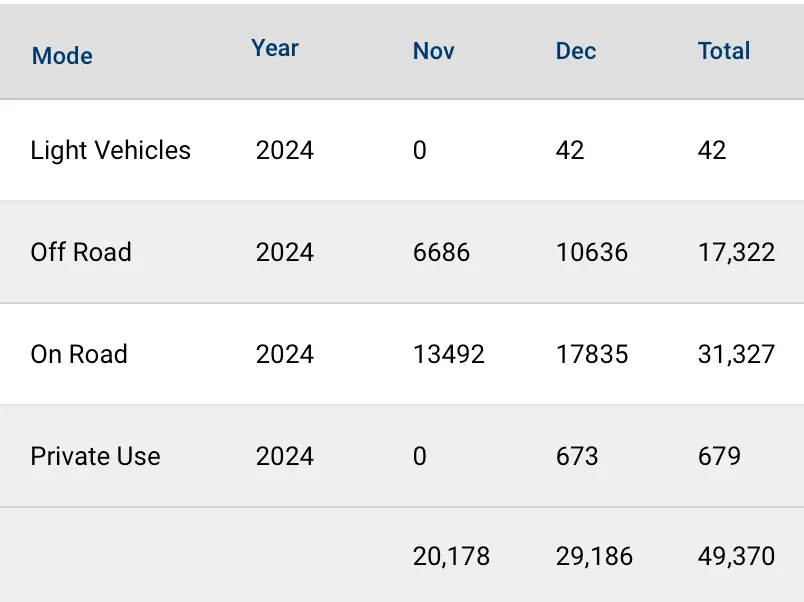

With the click of a button, Fuellox produces the Fuel Excise summary, which is a powerful tool to streamline your fuel excise recovery process.

Figure 1 - Fuellox Tax Report

Industries That Benefit the Most

1. Transport and Logistics

1. Transport and Logistics

2. Agriculture

2. Agriculture

3. Construction

3. Construction

4. On Site Refuelling

4. On Site Refuelling

How to Maximise Your Fuel Tax Rebates

To make the most of your fuel tax rebates, follow these steps:

1. Understand Eligibility

Familiarise yourself with the ATO’s guidelines to ensure you’re claiming all eligible rebates.

2. Invest in Automation

Manual tracking is prone to errors. Adopting systems like Fuellox ensures accurate, hassle-free reporting.

3. Keep Accurate Records

Maintain detailed records of fuel purchases, usage, and receipts. Fuellox simplifies this process with automated logs.

4. Consult Professionals

If you’re unsure about eligibility or the claiming process, consult a tax professional or contact the Fuellox team for guidance.

Let me share an example from one of our clients in the construction industry. They used to spend hours each month tracking fuel usage manually, leading to frequent errors and missed claims. After implementing Fuellox, their reporting process was fully automated, saving them over 15 hours of admin work per month and maximising their fuel tax credits.

Figure 2 - Fuellox Works with Any Tank and Pump

Fuellox Configuration for your Tank

See how Fuellox can install to your fuel tank now.

Why Fuellox Is a Game-Changer

Fuellox isn’t just about tax rebates; it’s a complete solution for managing fuel efficiently. The platform’s real-time data insights can help you:

- Reduce fuel wastage.

- Identify potential cost-saving opportunities.

- Streamline operations.

Take Control of Your Fuel Tax Rebates

Fuel tax rebates can make a significant difference to your bottom line, but only if you take the right steps to claim them effectively. With Fuellox, you can eliminate the hassle of manual tracking, generate accurate reports instantly, and maximise your rebates. If you need professional help setting up Fuellox or want to learn more about how it can benefit your business, feel free to contact us today. Let’s simplify your fuel management and save you time and money!

Fuellox Team Call Now - 1300 557 356